In the last post I talked about how to convince an owner who doesn’t want agencies. Well, in today’s post I’ll be explaining the steps to follow to find real estate investment opportunities.

When is the best time to buy? Which areas are likely to be most profitable? What price should I be paying? These are some of the questions you’ll likely be asking yourself as a real estate agent with investment clients. So, without further ado, let’s look at the 4 steps to follow to find a good investment opportunity for your clients.

1. ANALYSE THE TIME AND THE PLACE

The first thing you need to do is analyse the current situation of the real estate market. Look at the relationship between the sale and rental prices in the region you want to look for investment opportunities.

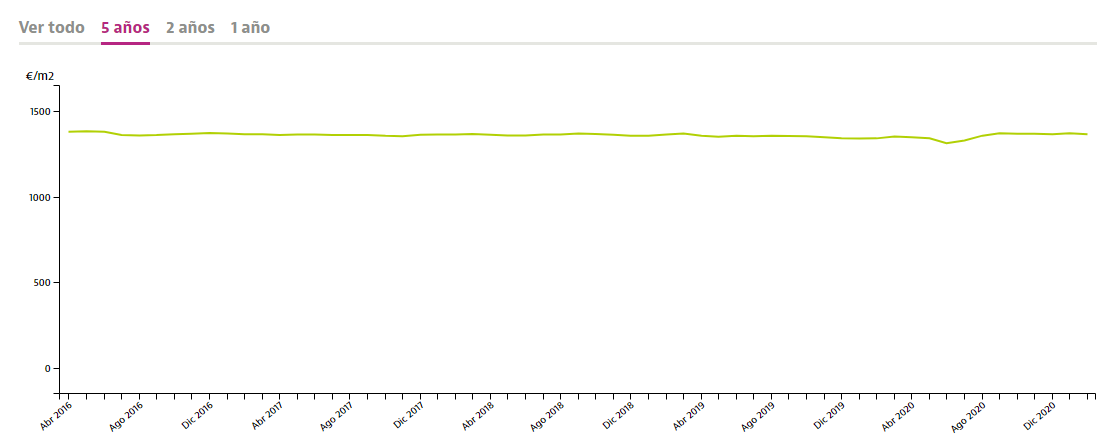

The following graphs show the development of the sale and rental prices in Asturias over the last 5 years.

In this region, sale prices have held steady during the last 5 years up to June last year. After the de-escalation in June 2020, there was a decrease in sales prices, which had a slight recovery in September. Today there is a slight decrease, which is expected to be accentuated throughout the first half of 2021.

Sale Price Asturias Trend (Source: Idealista)

Sale Price Asturias Trend (Source: Idealista)

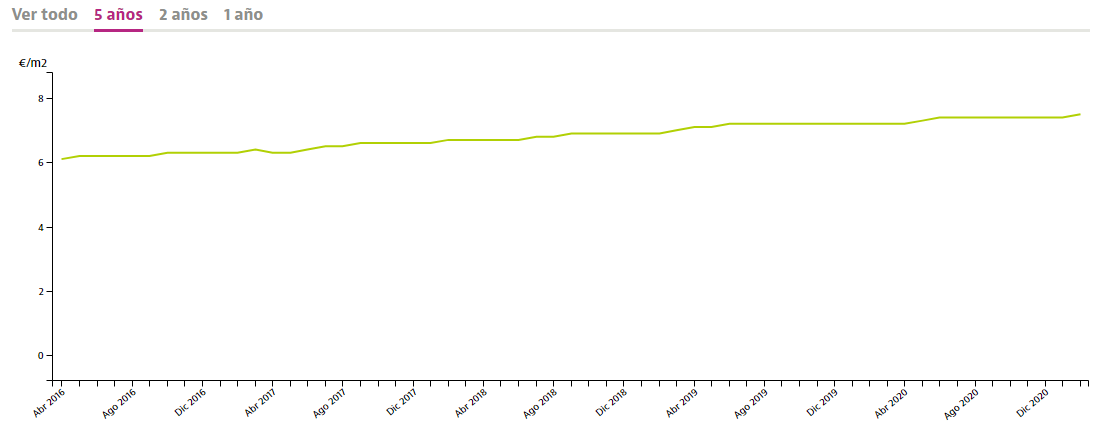

On the other hand, rental prices, unlike the sale prices, went up in June 2020, and have steadily increased since then. Keeping this data in mind, we can safely say that 2021 will be a good time to seek out investment opportunities in Asturias.

Rent Price Asturias Trend (Soruce: Idealista)

Rent Price Asturias Trend (Soruce: Idealista)

2. PICK AN AREA

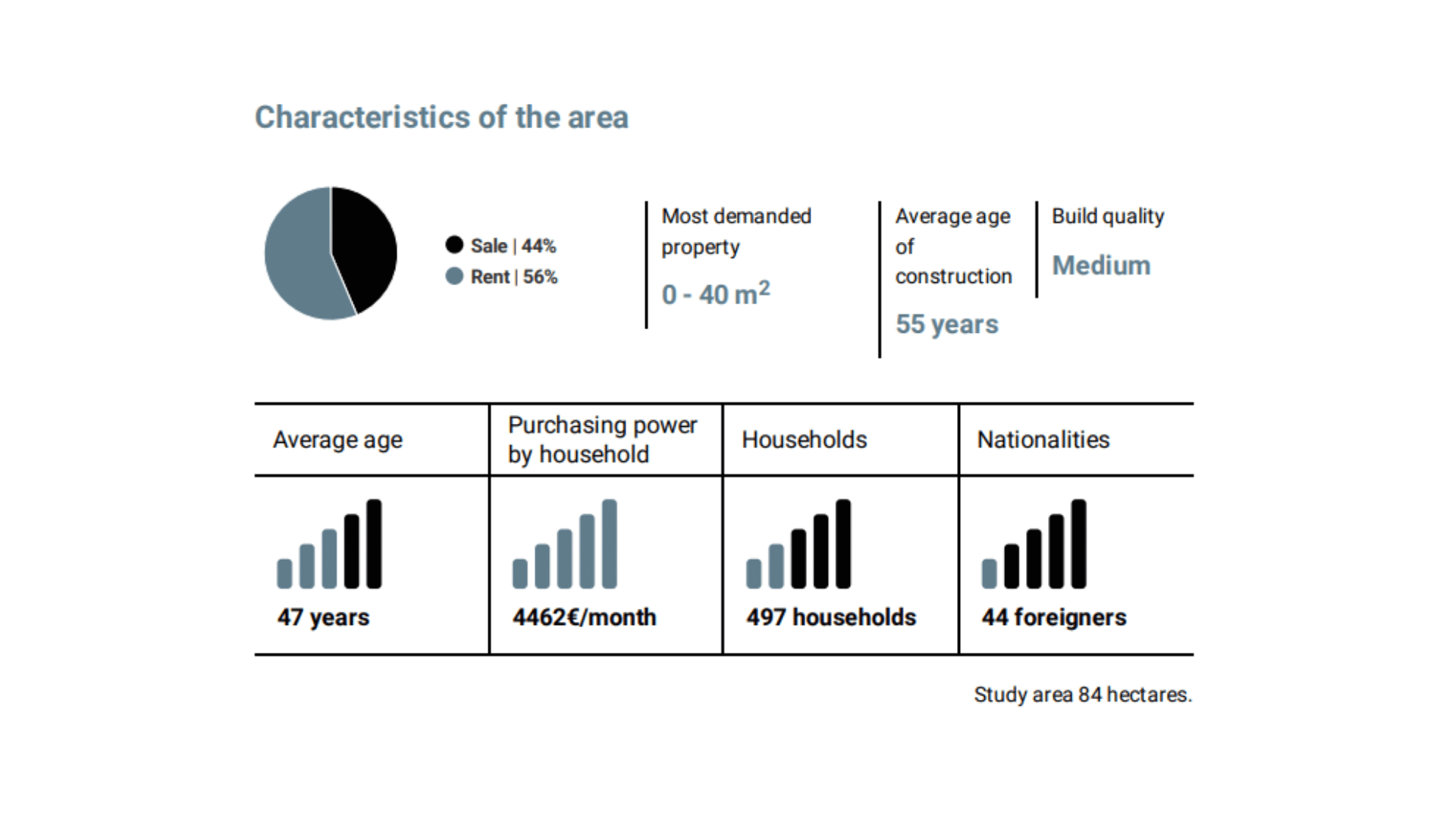

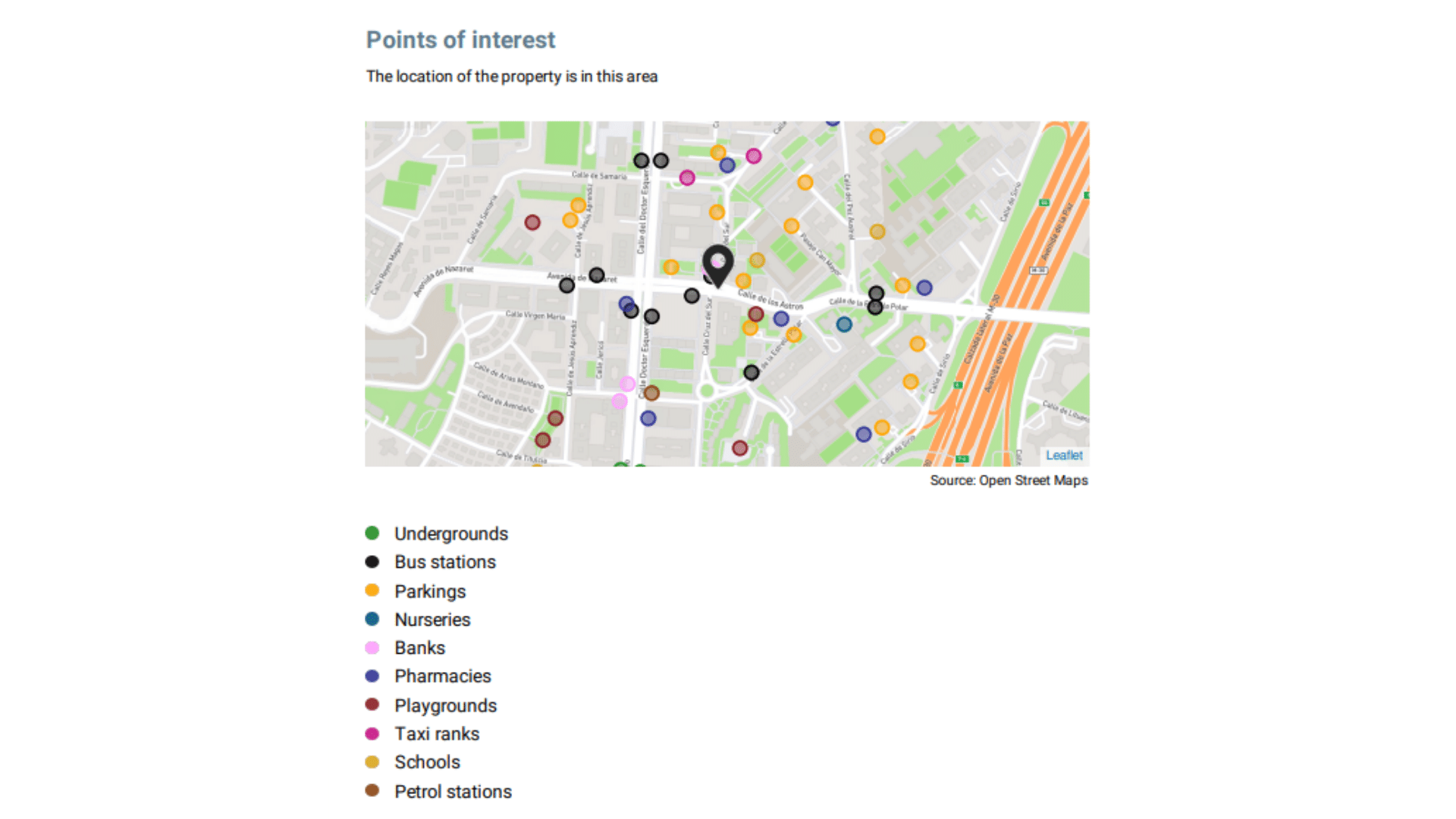

The next step is to choose an area with good profitability.Normally, areas with high profitability are located in the outskirts of cities, have good transport links and are close to amenities such as supermarkets, pharmacies, schools and parks.

Once you’ve settled on an area, start looking for opportunities. One way to find investment opportunities is by combing real estate portals one by one. Select the area you’ve chosen on each portal and check out all the listings to analyse whether the price is off market or not, ruling out any that are above market prices.

Then you also need to think about the potential risk of the area. To do that, you should visit the area for yourself and check out the atmosphere in the neighbourhood, local amenities and see whether it has good links to the city centre. These factors will give you a good idea of whether it’s a safe and well-connected area, things that will make renting the property more profitable.

Knowing the area for yourself has its advantages, but it does require you to invest a lot of time. If you’re looking at several potential areas, try not to spend too much time on each neighbourhood as you may miss out on opportunities.

Get FSBO leads

Try for free. No credit card required

3. CHOOSE A PROPERTY

Once you have shortlisted the properties, filter by profitable characteristics, such as short buildings or buildings with a maximum of 3 floors without a lift. These characteristics reduce the rental price, and people will accept not having certain amenities if it means the price is lower.

Once you’ve sifted through the properties, compare the gross and net profit margins of each property. A good gross profit margin is 7% or above. A study conducted by Idealista concludes that, ‘The gross profit margin from buying a house to rent it out increased by up to 7.5% in 2020, a tenth more compared to 2019.’

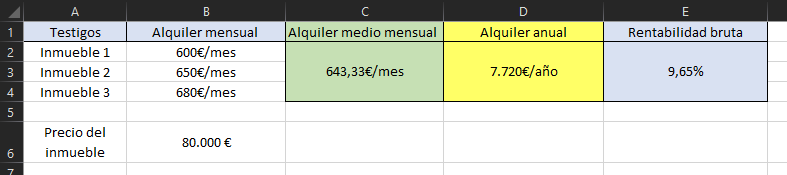

To calculate the approximate gross profit margin, choose several comparables with similar characteristics to the property you’re looking for and take the average to find out the approximate annual rent. Divide that annual rent by the investment and you’ll obtain the approximate gross profit margin. I recommend you do this in an Excel table. Here’s an example below.

Example: Imagine you’re looking for a property in area X with 2 beds, a lift and outside space for 80,000€. Then, choose 3 comparables for rent in that area that have similar characteristics; (Property 1 – 600€/month Property 2 – 650€/month Property 3 – 680€/month).

Next, take the average of the monthly rent and multiply that by 12 to get the annual rent. Once you have this figure (7,720€/year), to get the gross profit margin, divide 7,720€/year by the total investment; 80,000€ and multiply the result by 100. In this case, you’d have a good profit margin ➡️ 9.65%

Gross profit margin = (Annual rent/investment) x 100

To calculate the net profit margin, you need to know the property’s expenses. Reach out to the owners and find out the community fees, the property tax and the cost of insuring each property.

Net profit margin = (Annual rent – expenses/investment) x 100

4. PRICE

Once you have chosen the properties, analyse their price to see whether they truly are good opportunities and if they are, find out whether you can negotiate.

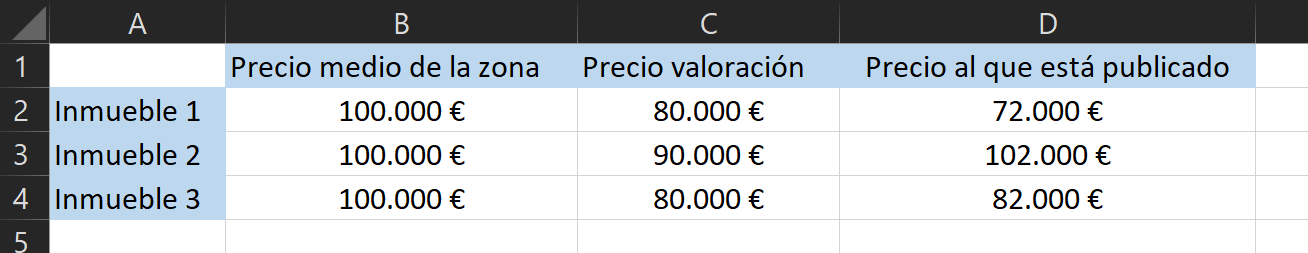

To compare each property create an Excel sheet like the one below, and compare the average price of the area compared to the valuation price and the price each property is listed at. That way you can find out whether the property is above or below the market price.

To confirm that the properties are at a reasonable price you should do a prior valuation of each of them, taking its characteristics and location into account.

Example: Imagine you analyse 3 properties from within your chosen area. One of them, property 1, is listed at 72,000€ and upon doing the valuation, you get 80,000€. This type of situation is very positive, since the property is advertised below its estimated price in an area with high profitability.

On the other hand, property 2 is significantly above market price, so you would rule out this option. Meanwhile, property 3 is only slightly above it, so you may be able to get them to bring the price down.Remember that this process should be done with each of the properties you choose.

Once you’ve chosen the area, compared the profit margins and selected the properties, submit a report to your investor client with each of the options.

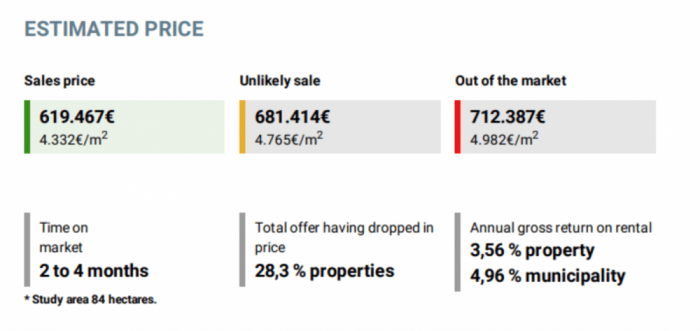

In this report you can include the estimated sale price, the estimated rental price and the gross annual rental profitability of the house and the region. These data will give your investor client a very clear picture of the profit margin they will have with each of the options.

At the same time, you can pair this investment report with the file for each property where they can see pictures and characteristics of it. In doing so you will be offering them a very complete report with data relevant to the investment and the characteristics of each property.

As you can see, it is a long process that requires time and attention, however these 2 reports will give your work credibility and at the same time make the decision easier for your investor client.

If you want to save yourself time and be the first to find investment opportunities, use Betterplace. All the data mentioned above can be obtained immediately.